Inventory Write-Off: Definition As Journal Entry and Example

By deducting COGS from revenue, companies can determine their gross profit, which is subject to taxation. Accurate reporting of COGS ensures compliance with tax regulations and helps minimize tax liability. Thus, costs are incurred for multiple items rather than a particular item sold. Determining how much of each of these components to allocate to particular goods requires either tracking the particular costs or making some allocations of costs.

- By deducting COGS from revenue, companies can determine their gross profit, which is subject to taxation.

- The gross profit percentage is closely watched by management and investors, since it is a strong indicator of whether your pricing policies and cost management are yielding a reasonable gross margin.

- A decrease in retained earnings translates into a corresponding decrease in the shareholders’ equity section of the balance sheet.

- A contra asset account is not classified as an asset, since it does not represent long-term value, nor is it classified as a liability, since it does not represent a future obligation.

Related AccountingTools Courses

Therefore, it is essential to correctly calculate the cost of goods sold in every reporting period. Whereas assets normally have positive debit balances, contra assets, though still reported along with other assets, have an opposite type of natural balance. However, that $1.4 billion is used to reduce the balance of gross accounts receivable. Therefore, contra accounts, though they represent a positive amount, are used to net reduce a gross amount.

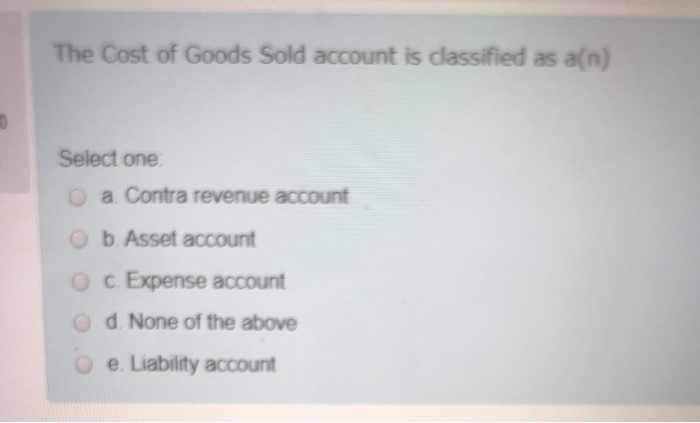

Contra Revenue vs. Cost of Sales

Again, the company’s management will see the original amount of sales, the sales discounts, and the resulting net sales. As we can see from the journal entries above, the seller should debit the exact amount of return to the revenue account or the sales return allowance account once the sale is returned. This sales return allowance account is the contra account to the sales revenue account.

What Is the Difference Between Cost of Sales and Cost of Goods Sold?

As can be seen using the two accounts, allows information about the original sale to be maintained on the revenue account, and details of the sale returns to be maintained on the sales returns contra revenue account. COGS is not addressed in any detail in generally accepted accounting principles (GAAP), but COGS is defined as only the cost of inventory items sold during a given period. Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on a company’s income statement, no deduction can be applied for those costs.

With this method, the business will know accurately which item was sold and its exact cost. The special identification method utilizes the assigned cost of each unit of inventory or goods to calculate the ending inventory and COGS for a particular period. The final inventory will then be counted at the end of an accounting period.

What are some typical (and perhaps non-typical) items reported as contra revenue? The amount to be written down is the difference between the book value of the inventory and the amount of cash the business can obtain by disposing of the inventory in the most optimal manner. Write-downs are reported in the same way as write-offs but an inventory write-down expense account is debited rather than an inventory write-off expense account. A decrease in retained earnings translates into a corresponding decrease in the shareholders’ equity section of the balance sheet. A business that produces or buys goods to sell must keep track of inventories of goods under all accounting and income tax rules.

When preparing an income statement, the amount in the sales return allowance is deducted from the total sales to calculate the company’s actual sales/net sales. If it were the credit sales, then we should credit to the account receivable account. If the sales were cash sales, we should credit them to the cash or bank account since the company will need to pay back to the customer.

If your company can find other suppliers of soap ingredients that you can only spend $4 on ingredients per bath soap, then the COGS will be reduced to $6 per bath soap. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, is cost of goods sold a contra account education, and more. Her expertise is in personal finance and investing, and real estate. Companies that don’t want to admit to such problems may resort to dishonest techniques to reduce the apparent size of the obsolete or unusable inventory. Leverage inventory management software to automate and streamline inventory tracking processes.