Adjusting Journal Entry: Definition, Purpose, Types, and Example

Adjustment entries ensure that all expenses and revenues are recorded in the correct period, even if they were not initially recorded. Accumulated depreciation refers to the accumulated depreciation of a company’s asset over the life of the company. On a company’s balance sheet, accumulated depreciation is called a contra-asset account and it is used to track depreciation expenses.

Why Adjustments Are Needed?

An adjusting journal entry is typically made just prior to issuing a company’s financial statements. Sometimes companies collect cash from their customers for goods or services that are to be delivered in some future period. Such receipt of cash is recorded by debiting the cash account and crediting a liability account known as unearned revenue. At the end of the accounting period, the unearned revenue is converted into earned revenue by making an adjusting entry for the value of goods or services provided during the period. Accrued vacation is the vacation time your employees earn but haven’t yet used. Think of it as a running tally of time off they’ve banked, ready to be enjoyed.

Unearned Revenues

The process of recording adjustment entries can be complex, but it is essential for maintaining the integrity of financial statements. Booking adjusting journal entries requires a thorough understanding of financial accounting. If the person who maintains your finances only has a basic understanding of bookkeeping, it’s possible that this person isn’t recording adjusting entries. Full-charge bookkeepers and accountants should be able to record them, though, and a CPA can definitely take care of it. Adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before financial statements are made. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement.

How Do You Calculate Accrued Vacation Time?

They also provide comprehensive reports that simplify financial reporting and analysis. While spreadsheets can be used, they are more prone to errors and require more manual effort. If you’re looking for a more streamlined and automated approach, consider exploring software solutions specifically designed for accrual management. Capped policies also mean you’ll need to manage the accounting for compensated absences, following guidelines like those outlined in ASC 710, which provides guidance on accounting for compensated absences. This involves correctly recording the expense when employees take their earned vacation.

How Does Accrued Vacation Impact Finances?

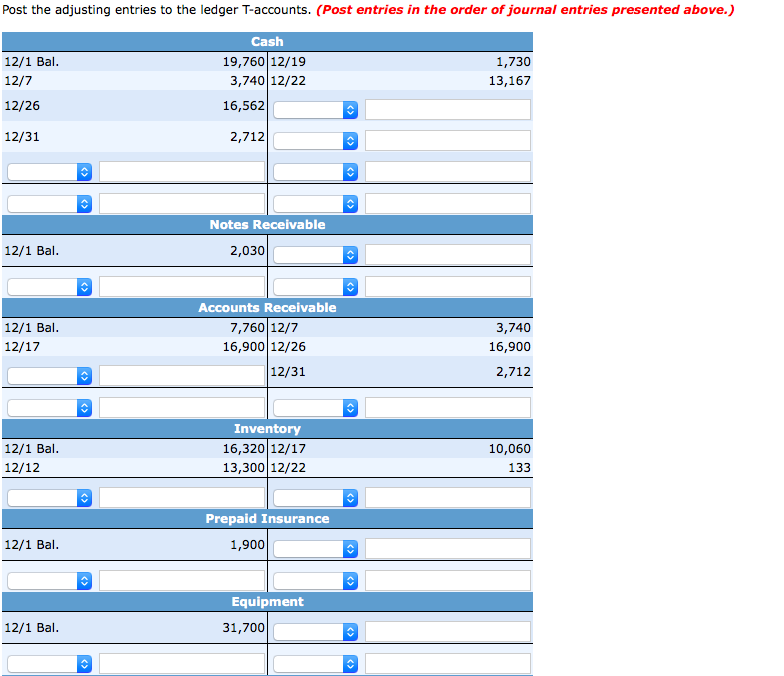

For example, if you have completed work for a client but haven’t yet billed for it, you’ll want to add an adjusting entry for accrued revenue. To reflect this, your accountant will add deprecation journal entries ($2,000 each year, say) to align with GAAP. Now that all of Paul’s AJEs are made in his accounting system, he can record them on the accounting worksheet and prepare an adjusted trial balance. These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step. In other words, we are dividing income and expenses into the amounts that were used in the current period and deferring the amounts that are going to be used in future periods.

- An adjusting entry is needed so that December’s interest expense is included on December’s income statement and the interest due as of December 31 is included on the December 31 balance sheet.

- To avoid this mistake, it is important to review and update estimates regularly.

- As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months.

- Ifaccountants find themselves in a situation where the cash accountmust be adjusted, the necessary adjustment to cash will be acorrecting entry and not anadjusting entry.

- At the end of an accounting period during which an asset is depreciated, the total accumulated depreciation amount changes on your balance sheet.

If you do your own accounting and you use the cash basis system, you likely won’t need to make adjusting entries. Under the cash method, revenue and expenses are recognized in the period in which the cash flows into or out of the company bank account. Adjusting journal entries are a common and completely natural aspect of financial accounting. That is, you must change the balance of at least two general ledger accounts with matching total amounts of debit and credit entries.

In all the examples in this article, we shall assume that the adjusting entries are made at the end of each month. In this article, we shall first discuss the purpose of adjusting 4 transfer pricing examples explained entries and then explain the method of their preparation with the help of some examples. Mr. Jeff, an owner of Azon, wants to ensure the company’s inventory (or stock).

Prepaid expenses refer to assets that are paid for and that are gradually used up during the accounting period. A common example of a prepaid expense is a company buying and paying for office supplies. For example, if you place an online order in September and that item does not arrive until October, the company you ordered from would record the cost of that item as unearned revenue.

If it’s petty cash, then you should have a petty cash count at the end of the period that matches what is shown on the trial balance (which is the ledger balance). If they don’t, you have to do some research and find out which one is right, and then make a correction. Payments for goods to be delivered in the future or services to be performed is considered unearned revenue. Liabilities also include amounts received in advance for a future sale or for a future service to be performed. The primary objective of accounting is to provide information that will help management take better decisions and plan for the future. It also helps users (lenders, employees and other stakeholders) to assess a business’s financial performance, financial position and ability to generate future Cash Flows.

How often you calculate and record this accrual—whether per pay period, monthly, or quarterly—depends on your company’s structure and preferences. Smaller companies might find monthly accruals manageable, while larger organizations may prefer a quarterly approach. This article offers further insights into choosing the right frequency for your business. Start at the top with the checking account balance or whatever is the first account on the trial balance.