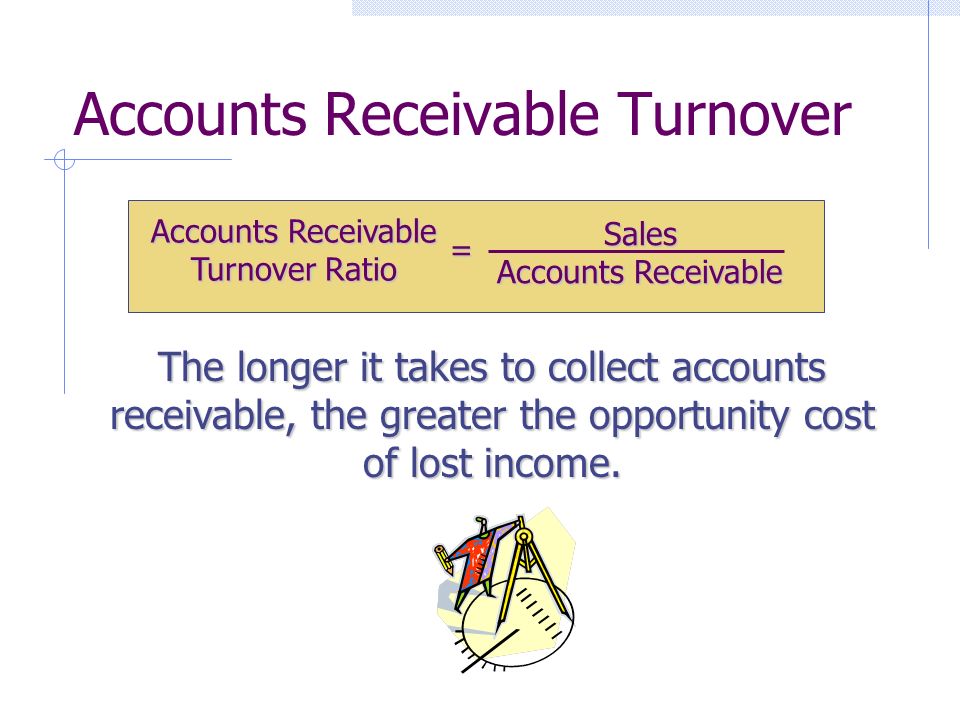

Accounts Receivable Turnover Ratio Formula + Calculator

For instance, industries with shorter payment cycles, such as retail, may have higher turnover ratios, while industries with longer payment cycles, such as manufacturing or construction, may have lower ratios. To calculate the receivable turnover in days, simply divide 365 by the accounts receivable turnover ratio. Another reason you may have a high receivables turnover is that you have strict or conservative credit policies, meaning you’re careful about who you offer credit to.

Benefits of Using an Accounts Receivable Turnover Ratio Calculator

As a result, customers might delay paying their receivables, which would decrease the company’s receivables turnover ratio. A high ratio indicates that a company is efficiently collecting its receivables and converting them into cash quickly, which is a sign of good credit management and cash flow health. Receivables turnover ratio is a measure of how effective the company is at providing credit to its customers and how efficiently it gets paid back on a given day. Moreover, if you believe your business would benefit from experienced, hands-on assistance in accounting and finance, it’s always good to consult a business accountant or financial advisor.

What does a high Accounts Receivable Turnover Ratio indicate?

It is an efficiency ratio used to quantify how well a company is managing the credit that they extend to their customers by evaluating how long it takes to collect the outstanding debt throughout the accounting period. Higher turnover ratios imply healthy credit policies, strong collection processes, and relatively prompt customer payments. You’re also likely not to encounter many obstacles when searching for investors or lenders. Lower turnover ratios indicate that your business collects on its invoices inefficiently and is cause for concern. At the end of the day, even if calculating and understanding your accounts receivable turnover ratio may seem difficult at first, in reality, it’s a rather simple (and certainly important) accounting measurement. Once you’ve used the accounts receivable turnover ratio formula to find your rate, you can identify issues in your business’s credit practices and help improve cash flow.

Accounts Receivables Turnover Ratio Calculator

When evaluating an externally-calculated ratio, ensure you understand how the ratio was calculated. The receivables turnover ratio is just like any other metric that tries to gauge the efficiency of a business in that it comes with certain limitations that are important for any investor to consider. In essence, it helps you keep your financial operations on track and your customers’ payments flowing smoothly. Low A/R turnover stems from inefficient collection methods, such as lenient credit policies and the absence of strict reviews of the creditworthiness of customers. The average accounts receivable is equal to the beginning and end of period A/R divided by two. You can use FreshBooks’ net 30 invoice template to ensure the terms are clear, indicating that you expect payment within 30 days.

A company can improve its ratio calculation by being more conscious of who it offers credit sales to in addition to deploying internal resources towards the collection of outstanding debts. A high receivables turnover ratio can indicate that a company’s collection of accounts receivable is efficient and that it has a high proportion of quality customers who pay their debts quickly. A high receivables turnover ratio might also indicate that a company operates on a cash basis.

MORE INDUSTRIES

- The higher the number of days it takes for customers to pay their bills results in a lower receivable turnover ratio.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- For our illustrative example, let’s say that you own a company with the following financials.

- This is a great way to increase this ratio as it motivates the clientele of yours to pay faster and be punctual for all future transactions resulting in increased revenue generation.

- As long as you get paid or pay in cash, sure, the act of buying or selling is immediately followed by payment.

It also serves as an indication of how effective your credit policies and collection processes are. The accounts receivable turnover ratio measures the number of times a company’s accounts receivable balance is collected in a given period. A high ratio means a company is doing better job at converting credit sales to cash. However, it is important to understand that factors influencing the ratio such as inconsistent accounts receivable balances may inadvertently impact the calculation of the ratio.

To find their accounts receivable turnover ratio, Centerfield divided its net credit sales ($250,000) by its average accounts receivable ($50,000). Receivables turnover ratio (also known as debtors turnover ratio) is an activity ratio which measures how many times, on average, an entity collects its trade receivables during a selected period of time. It is computed by dividing the entity’s net credit sales by its average receivables for the period.

And more than half of them cite outstanding receivables as their biggest cash flow pain point. Managers should continuously track their entity’s receivables turnover ratio on a trend line to observe the gradual ups and downs in turnover performance. We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions.

A low ratio suggests that a company may be struggling with collecting receivables, which could indicate poor credit management or issues with customers paying on time. This ratio is important because it provides insights into how efficiently a company manages and collects its receivables. A higher ratio indicates effective 19 accounting and bookkeeping software tools loved by small business collection practices and better cash flow management. Providing multiple ways for your customers to pay their invoices, will make it easier for them to match what their own financial process. Consider accepting online payments through Apple Pay or PayPal as well as traditional methods of checks and cash.